The exponential moving average is a type of moving average (MA) that places a greater weight and significance on the most recent data points. But a question arises: Can it be used to develop a profitable trading strategy?

We backtest the following trading rules:

➨ We buy the asset when the 20-day EMA is under the asset price

➨ We sell the asset when the 20-day EMA is over the asset price

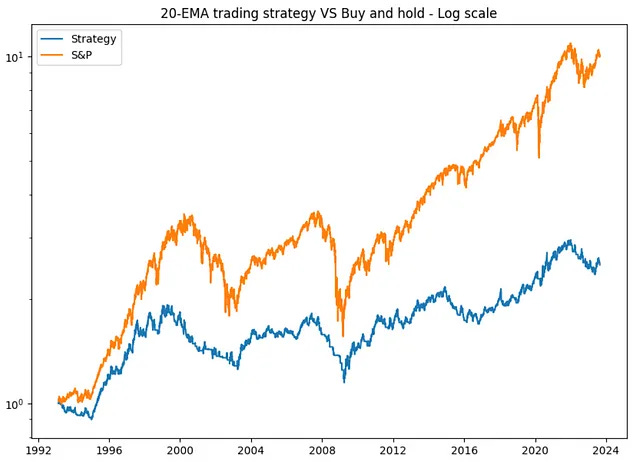

We backtested the strategy using the ETF version of the S&P 500, SPY. The data is not adjusted for dividends and splits. Below is the equity curve.

We also improved the 20 EMA Trading Strategy by adding an extra trading indicator as a filter. Check how it perform here >>

https://www.quantifiedstrategies.com/20-ema-trading-strategy/