200 Day Moving Average Trading Strategy – (backtest and indicator)

The main advantages of the 200-day moving average are simplicity, riding the trend, and playing defense. However, without a recession and falling prices, you are unlikely to beat buy-and-hold because of the many whipsaws. As with most things in life, the 200-day moving average comes with both pros and cons. The 200-day moving average strategy is no silver bullet.

We backtest the following trading rules:

Buy when the close of the S&P 500 crosses above the 200-day average,

Sell when it closes below the average.

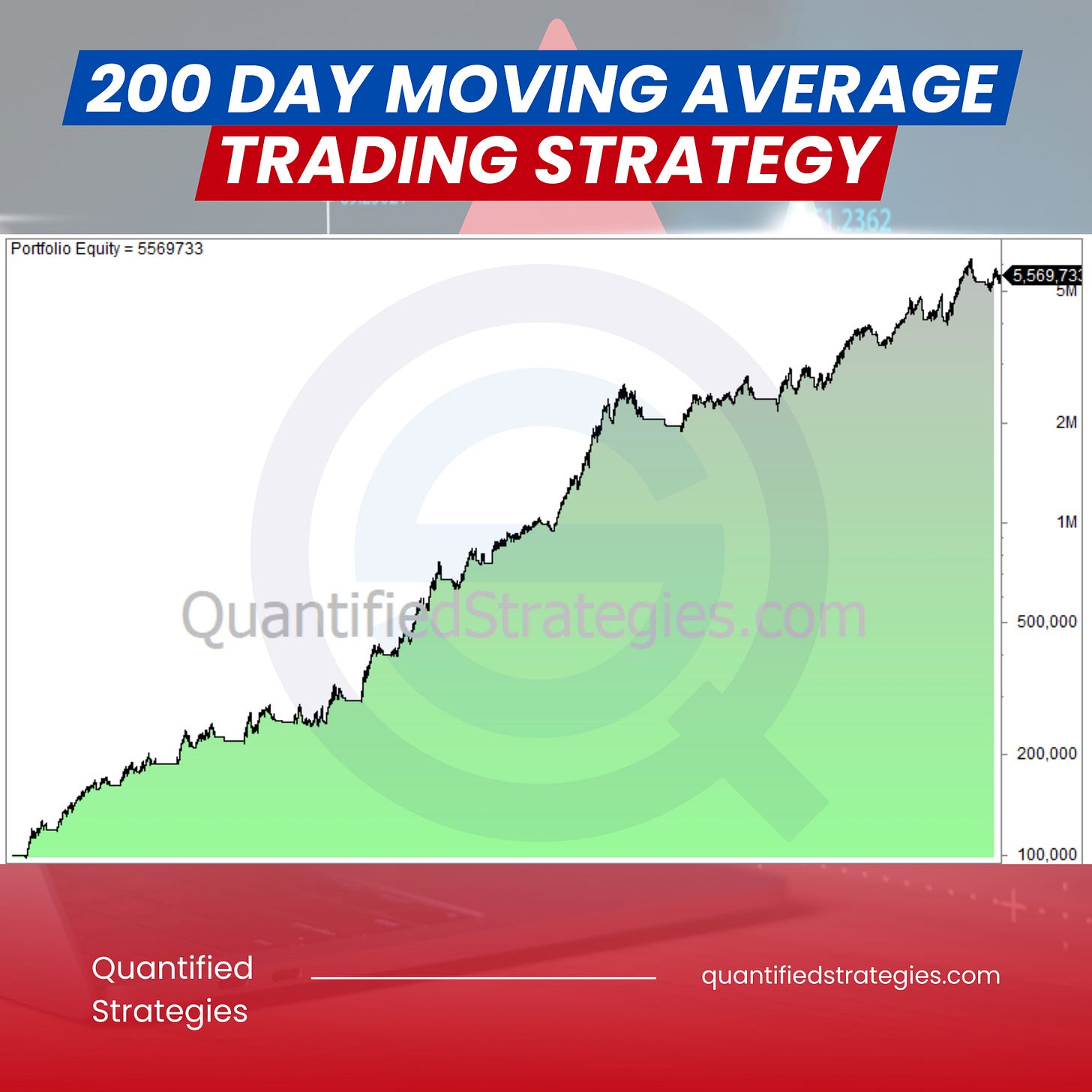

This is a crossover system. It can't get any simpler than that! Here is the return (log chart shown below) of investing 100 000 in 1960 and reinvesting and compounding until today.

We backtest Siegel’s (Professor at Wharton) strategy and see how it compares to our original 200-day moving average strategy (We test on S&P 500 from 1960 until today) >>

https://www.quantifiedstrategies.com/200-day-moving-average/