The main advantages of the 200-day moving average are simplicity, riding the trend, and playing defense. However, without a recession and falling prices, you are unlikely to beat buy-and-hold because of the many whipsaws. As with most things in life, the 200-day moving average comes with both pros and cons. The 200-day moving average strategy is no silver bullet.

This post looks at the 200 day moving average and how it works, why it works, and additionally why it sometimes doesn’t work. We present a 200-day moving average strategy and the simple 200-day moving average rule.

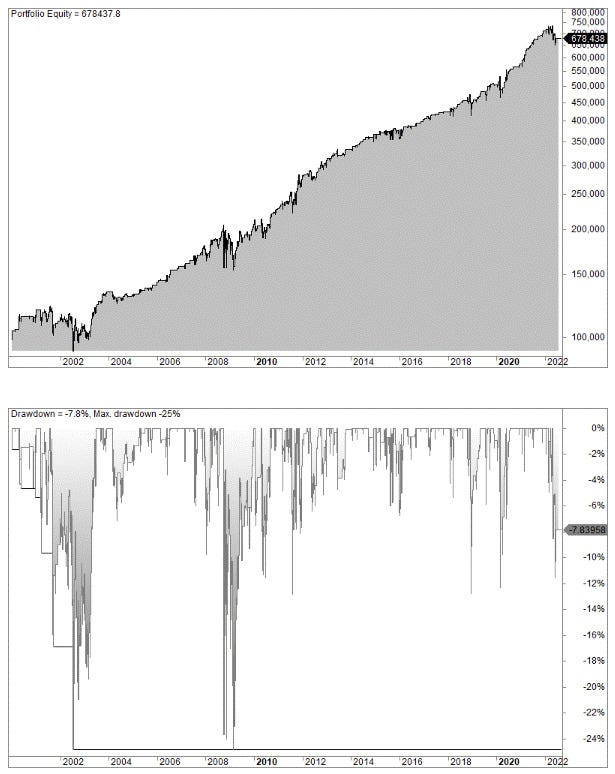

We backtest the following trading rules:

Buy when the close of the S&P 500 crosses above the 200-day average,

Sell when it closes below the average.

The equit curve is shown below.

You can find more info about this trading strategy here:

https://www.quantifiedstrategies.com/200-day-moving-average/

#tradingstrategies #MovingAverage #TrendFollowing #SP500 #Backtesting #TradingStrategy #StockMarket #TechnicalAnalysis