3 Best Mean Reversion Trading Strategies: Backtested Buy and Sell Signals Analysis and Insights

Today we are presenting three free mean reversion strategies. They were partially published on this website a few years back, and today we make some minor adjustments and present their performance on different ETFs. Furthermore, we discuss why mean reversion works and which markets are best for mean reversion trading strategies, and also some historical backtesting.

We backtest the following trading rules:

Calculate an average of the H-L over the last 25 days.

Calculate the (C-L)/(H-L) ratio every day (IBS).

Calculate a band 2.25 times lower than the high over the last 25 days by using the average from point number 1.

If XLP closes under the band in number 3, and point 2 (IBS) has a lower value than 0.6, then go long at the close.

Exit when the close is higher than yesterday’s high.

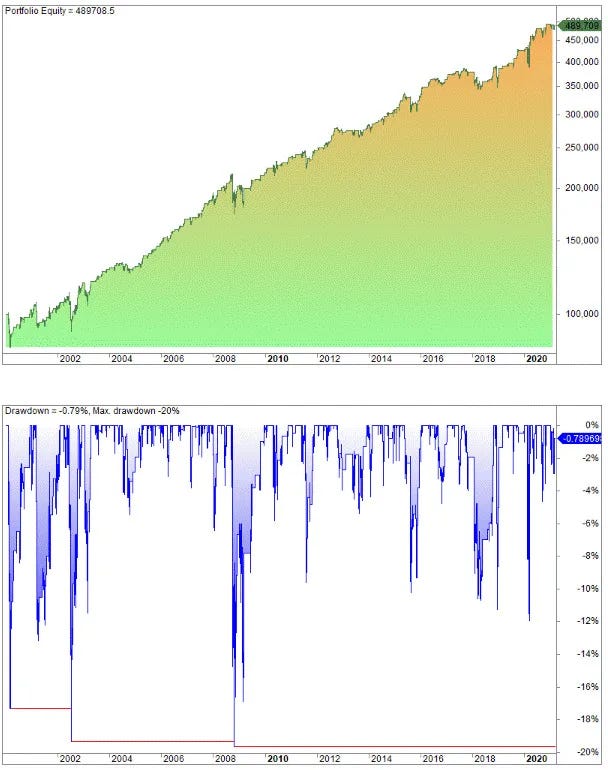

100 000 invested at inception and compounded until today has produced decent returns (Shown below)

You can find more info about this trading strategy here:

https://www.quantifiedstrategies.com/3-free-mean-reversion-trading-strategies/