Since 1993, all the gains in the S&P 500 have come from owning the index from the close to the open the next day. We see the same tendency in the gold markets. Thus, we can develop night trading strategies to take advantage of this bias. At the end of the post, we update the results of an overnight trading strategy we published in 2014.

Overnight stock trading strategies are popular for a good reason: they offer good risk and reward. All markets are different and have their own seasonalities and tendencies, but in the stock market, the tendency is for the gains to accrue during the night — ie. an overnight bias. This means that night trading and overnight trading strategies in stocks get a boost from this effect/bias.

By night trading we mean holding positions overnight — from the close of the trading day until the open the next day. In other words, night trading is the same as overnight trading.

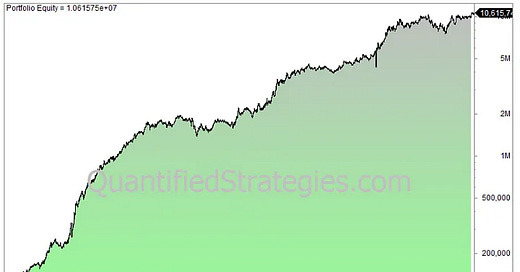

Let’s have a look at this chart that shows the accumulated returns of owning the S&P 500 from the close to the open the next day since SPY’s inception in 1993.

The chart shows 100,000 invested and compounded in the ETF SPY from 1993 until today. Clearly, there is an edge! You have a nice tailwind you can take advantage of when building strategies.

You can find more info about this trading strategy here:

https://www.quantifiedstrategies.com/overnight-trading/