9 More Free Trading Strategies

Did you know that we also have a Twitter account where we publish unique trading strategies and ideas?

To not miss out on any of them then give us a follow.

Below you can find examples of some of our strategies and ideas not published anywhere else:

Tomorrow, Friday, is the monthly jobs report.

The upper chart is returns from the open to the close (avg 0.07%) (job report day).

The lower chart is from Thursday's close until the close of Friday (the day of the report). 0.13% avg.

$SPY $SPX

December is a good month for #stocks: average gain is 1.4% and a 75% chance of going up.

(Probably helped by rising bonds?)

$SPX invested only in December:

Below is the equity curve of being invested in $SPX before and after each holiday.

3.5% CAGR, exposure 19%. Max drawdown 24%.

Two of the holidays are consistently poor, though.

One of the best periods of the year for #stocks is from today until the next year.

Below is the equity curve when invested in $spx from the week before Thanksgiving until the close of the year:

The average is 2.1%.

We are entering the strongest seasonality for #stocks: the first three trading days of the month.

We have mentioned this multiple times (low-hanging fruit).

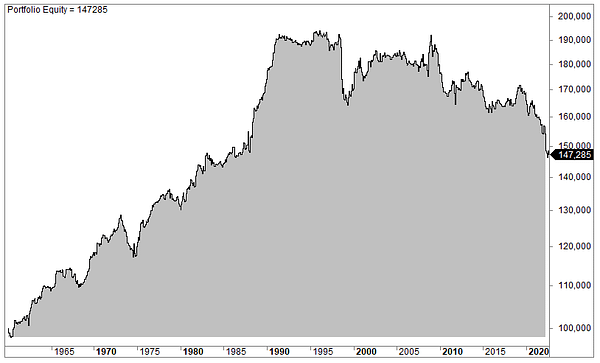

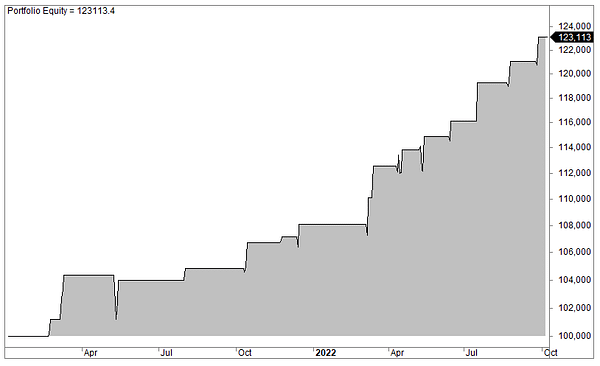

Below is the equity curve of being invested in $spx only during the first three trading days of the month (since 1960):