A Gold Strategy

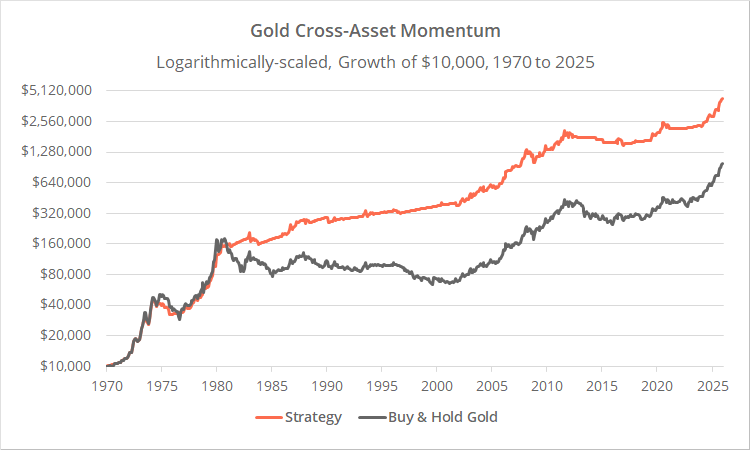

Gold is often thought of as a safe haven, but its price doesn’t always go up. A simple momentum-based approach can help decide when it makes sense to be invested.

This article is based on an article by Allocate Smartly called Gold Cross-Asset Momentum.

The strategy uses two 12-month total return signals: one for gold (via GLD) and one for 10-year U.S. Treasuries (IEF). When both returns are positive at month-end, you go long gold. If either is negative, you stay in cash until the next signal.

This dual-momentum filter avoids many low-performance periods. It’s simple on purpose: fewer parameters help reduce overfitting. Over the past 50 years, this rule tended to cut losing exposure and improved returns versus a naive gold-only momentum approach.

However, it has worked less well during the roaring bull market over the last to decades (since GLD’s inception):

In backtests, the annualized return on GLD has been roughly ~6 % using this rule, compared with buy-and-hold around ~10 % (results vary by timeframe and cash returns). The edge comes mostly from avoiding long stretches of weak gold performance.

Because gold can go long periods of underperformance and cash returns vary, this strategy works best as a small part of a diversified portfolio or as an overlay signal confirming other gold trades.

Appreciate the honest comparison showing buy-and-hold actually outperformed the strategy since GLD inception. Most momentum write-ups cherry pick time periods to make returns look better than they are. The dual filter approach using IEF as confirmation makes sense tho, it helps avoid the periods where gold just bleeds slowly while rates rise. I've been running a simpler relative strength approach on commodities and the main value is definately in avoiding the worst drawdowns, not beating buy-and-hold.