You can trade on market sentiment indicators by using the AAII sentiment index. When the AAII index is very bullish, you can expect mediocre or below-average returns in the next four weeks. When the AAII index is very bearish, you can expect above-average returns over the next four weeks. That said, we believe there are better ways and indicators to trade the market.

We backtest the following trading rule:

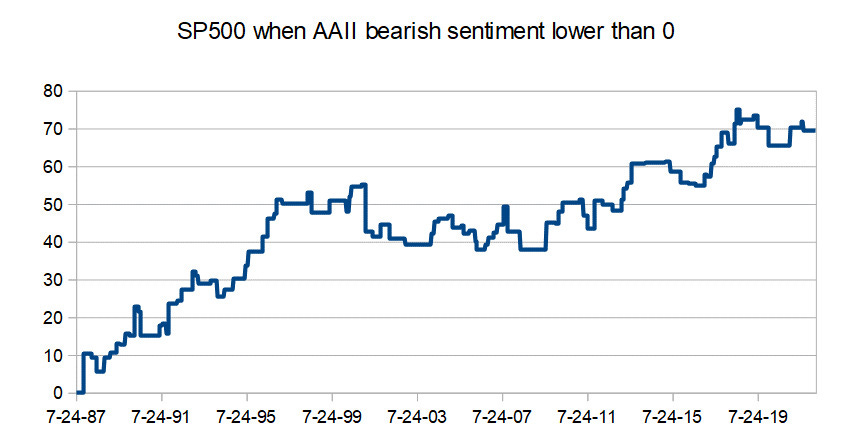

We start by testing the performance of the S&P 500 when the AAII market sentiment goes negative (when the respondents are more bearish than bullish), shown in column G in the spreadsheet above (bull-bear-spread). By negative, it means that the bull-bear-spread turns negative. We hypothesize that this might trigger a price rise because many players are on the wrong side of the pendulum. When too many are bearish, only a slight change in optimism might turn the market around.

We test by going long at the end of the week when it turns negative, and we sell four weeks later. Below is the cumulative profits since 1987.

We do another AAII and Market Sentiment Indicators backtest changing the criteria, and we go long when the bull-bear-spread is lower than -20.

Check here how it performs>>

https://www.quantifiedstrategies.com/aaii-and-market-sentiment-indicators/