The Chande momentum oscillator is a technical indicator that measures momentum through the daily value change in the security. But the question arises: Can a profitable strategy be developed using it?

In this post, we are going to look at what the Chande momentum oscillator is, how to calculate it, and backtest a trading strategy using Python to see whether it is profitable or not.

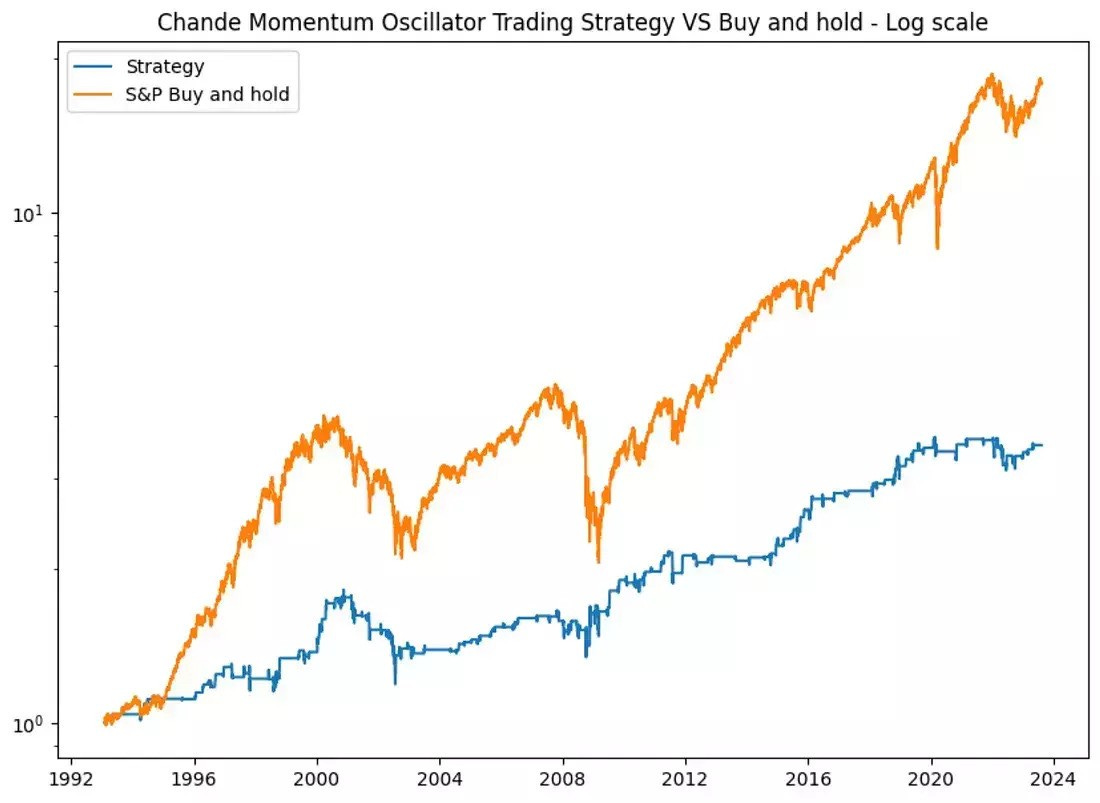

We backtest the following trading rules:

* We buy when the Chande momentum oscillator is under -50

* We sell either when the oscillator crosses above 50 or 5 days after the buy signal was triggered

We backtested the trading strategy using the SPY ETF. The data is adjusted for dividends. Below is the equity curve for our Python backtest.

We explain the metrics and performance statistics about the strategy here >>

https://www.quantifiedstrategies.com/chande-momentum-oscillator-trading-strategy/