Crude Oil Strategy, Twitter Strategies, Day Trading Crypto (And More)

Twitter trading strategies:

Many Python traders have developed code to trace Twitter sentiment for certain stocks. Is this a tradable strategy? We described the methods and found some evidence it’s working:

If you like our work please have a look at our products:

Weekly Strategy Report With Backtests And Code

Backtesting Course

Monthly Strategy Club

Candlestick Patterns - 75 Backtested

Swing Trading Course

More products here

Crude oil trading strategy:

Is it possible to make money trading crude oil? We believe it’s a pretty tough asset to trade, and we explain why in our article (including backtests):

European trading strategies:

There are many futures contracts to trade in Europe. In the linked article below we had a look at two strategies in the DAX-40 contract.

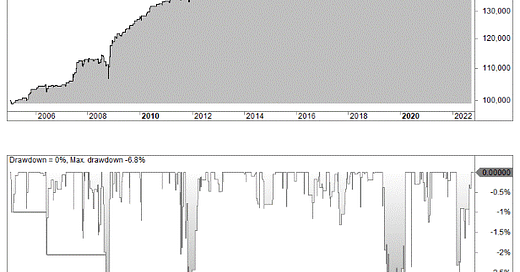

The equity curve of two overnight DAX strategies:

Buy and hold strategy:

Should you buy and hold or trade? It’s like comparing apples and oranges. We did some backtesting for comparisons:

Macro trading strategies:

George Soros and Ray Dalio are expert macro trading managers. Can you master macro trading strategies?

Carry trade strategy:

A carry trade strategy involves, for example, borrowing in a low-interest rate currency and investing in another currency with a higher interest rate. However, this is a strategy that doesn’t resonate with us. Read here for why:

Institutional trading strategy:

We believe the goal of any aspiring retail trader should be to trade like a big institution: trade many strategies across different asset groups, trade different time frames, and above all, trade both market directions (long and short).

Daily trading strategy:

Some active traders like to trade daily, opening and closing their trades within the trading day. This manner of trading requires having a daily trading strategy.

Day trading cryptocurrency strategy:

Is it possible making money day trading crypto? We argue it’s pretty unlikely: