Day Trading, Derivatives, Corn Futures Strategy, And E-Mini Strategy

A day trading strategy:

Day trading is popular, but it’s tough to make money in a zero-sum game, and especially if you don’t have a backtested plan. Below we provide you with an example of a day trading strategy (that can be improved):

If you like our work please have a look at our products:

Weekly Strategy Report With Backtests And Code

160 strategies (in Amibroker code and logic in plain English)

Monthly Strategy Club

Candlestick Patterns - 75 Backtested

Day trading Course

More products here

Derivatives trading strategy:

What is a derivative? Can you make a derivatives trading strategy?

How to backtest a trading strategy

Our website is all about backtesting and quantified trading strategies. If you’re new to backtesting, you might find this article a useful introduction to backtesting:

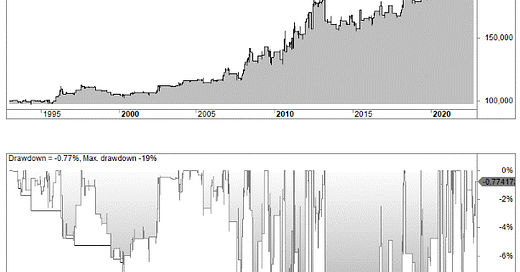

Corn futures strategy:

Corn and other commodities are hard to trade, but many of them have very strong seasonal trends. We backtested corn:

E-mini Trading Strategy

With e-minis, the Chicago Mercantile Exchange’s Globex electronic trading platform has made it possible for individuals with less capital to play the futures and commodity markets from around the world. How can you make any money trading it? We provide a specific trading strategy:

Earnings Report Trading Strategy

The earnings reports often come with increased volatility. Can you profit from that? It turns out you can: