A Death Cross involves two moving averages – one short and one long, normally the 50 and 200-day moving averages. When the short moving average crosses below the long one, a Death Cross is formed. As a trading signal, it works reasonably well.

Backtests reveal that the Death Cross signals short-term weakness, but in the long term, it also takes you out of many positions prematurely. If you sell when a Death Cross is formed and reenter when the opposite signal occurs, a Golden Cross, the returns are in line with the long-term averages, but you have less drawdowns (and pain?) along the way.

We backtest the following trading rules:

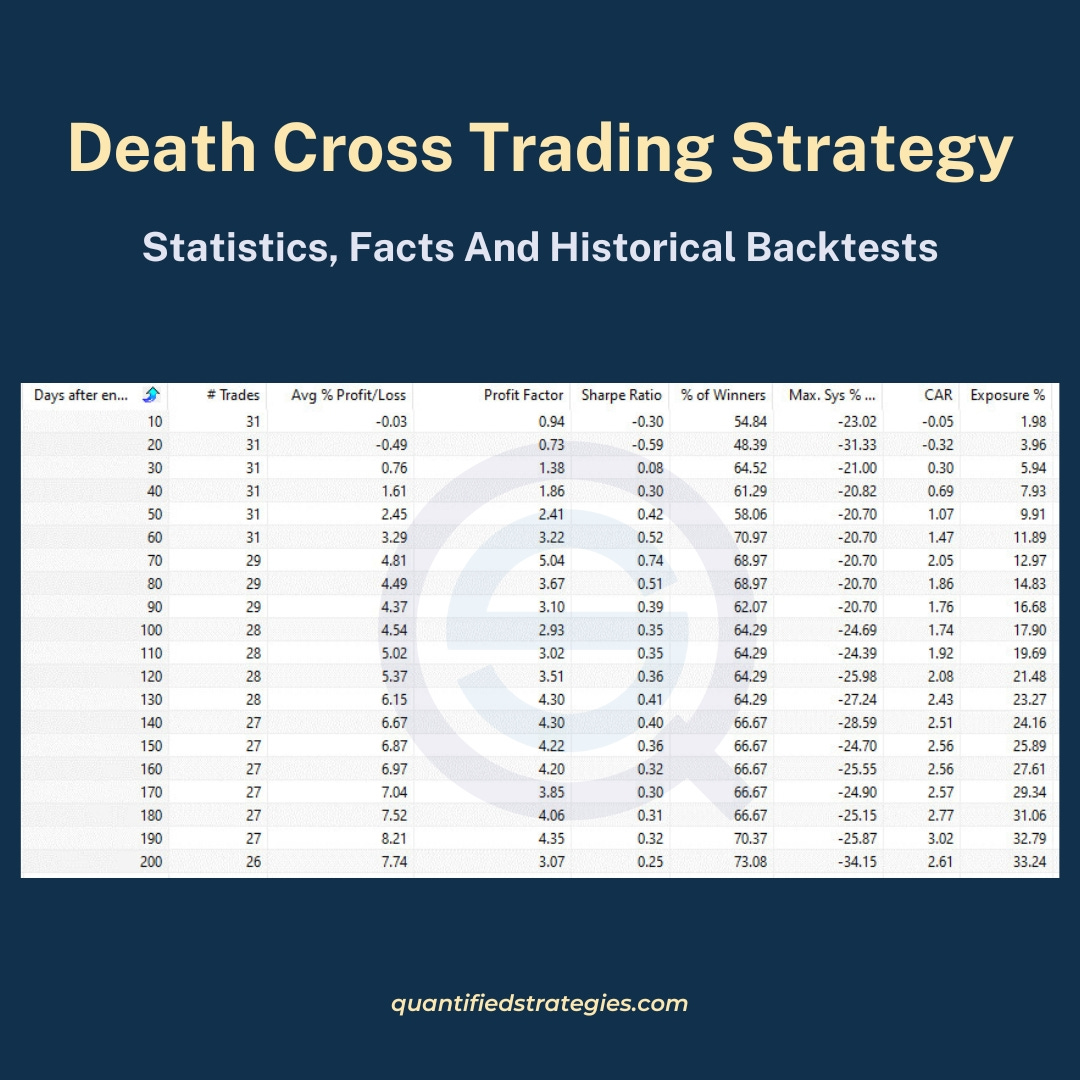

We use 50 and 200-day moving averages and exit after N-days. We backtest the Death Cross in the S&P 500 because it’s the only asset we have with data going back many decades (1960).

The results from the backtest is shown below.

What happens if we enter a position on a Death Cross and sell at a Golden Cross? Check out here >>

https://www.quantifiedstrategies.com/death-cross-in-trading/