The dual momentum trading strategy by Gary Antonacci is a method of investing that selects only assets that have outperformed their peers over a given time and also making positive returns. It is based on the idea that an asset with a superior relative momentum and a positive absolute momentum would continue to perform until another outperforms it. Thus, it is a sort of trend strategy.

We backtest the following trading rules:

» Did S&P 500 outperform US Treasury Bills over the last 12 months?

» If the answer is no, then buy US Treasury Bills.

» If the answer is yes, did S&P 500 outperform the world index (ex. USA) over the last 12 months?

» If S&P 500 outperformed the world index, then buy S&P 500.

» If S&P 500 underperformed the world index, then buy the world index (global stocks).

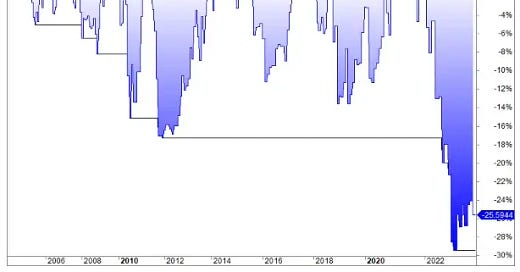

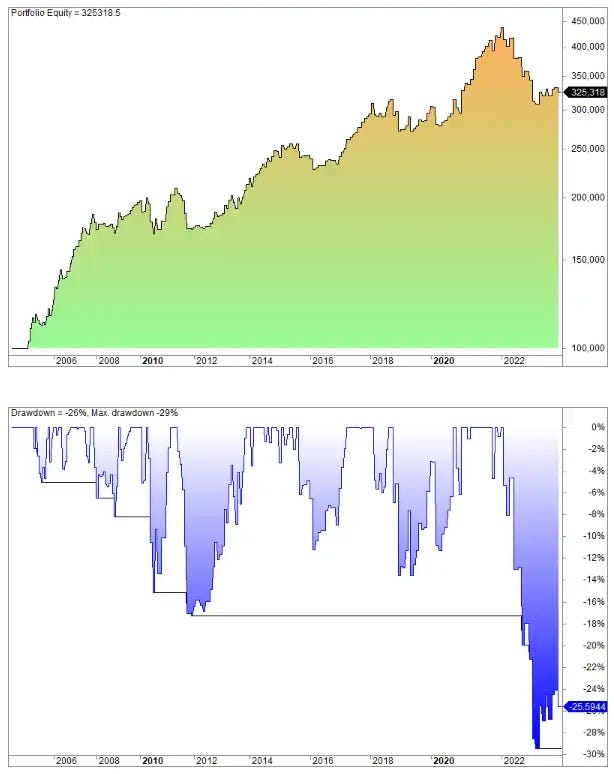

The equity curve of the strategy is shown in the image.

You can find more info about this trading strategy here:

https://www.quantifiedstrategies.com/dual-momentum-trading-strategy/

#DualMomentum #GaryAntonacci #InvestmentStrategy #tradingstrategy #systematictrading #investing #trading #tradingtips #algotrading