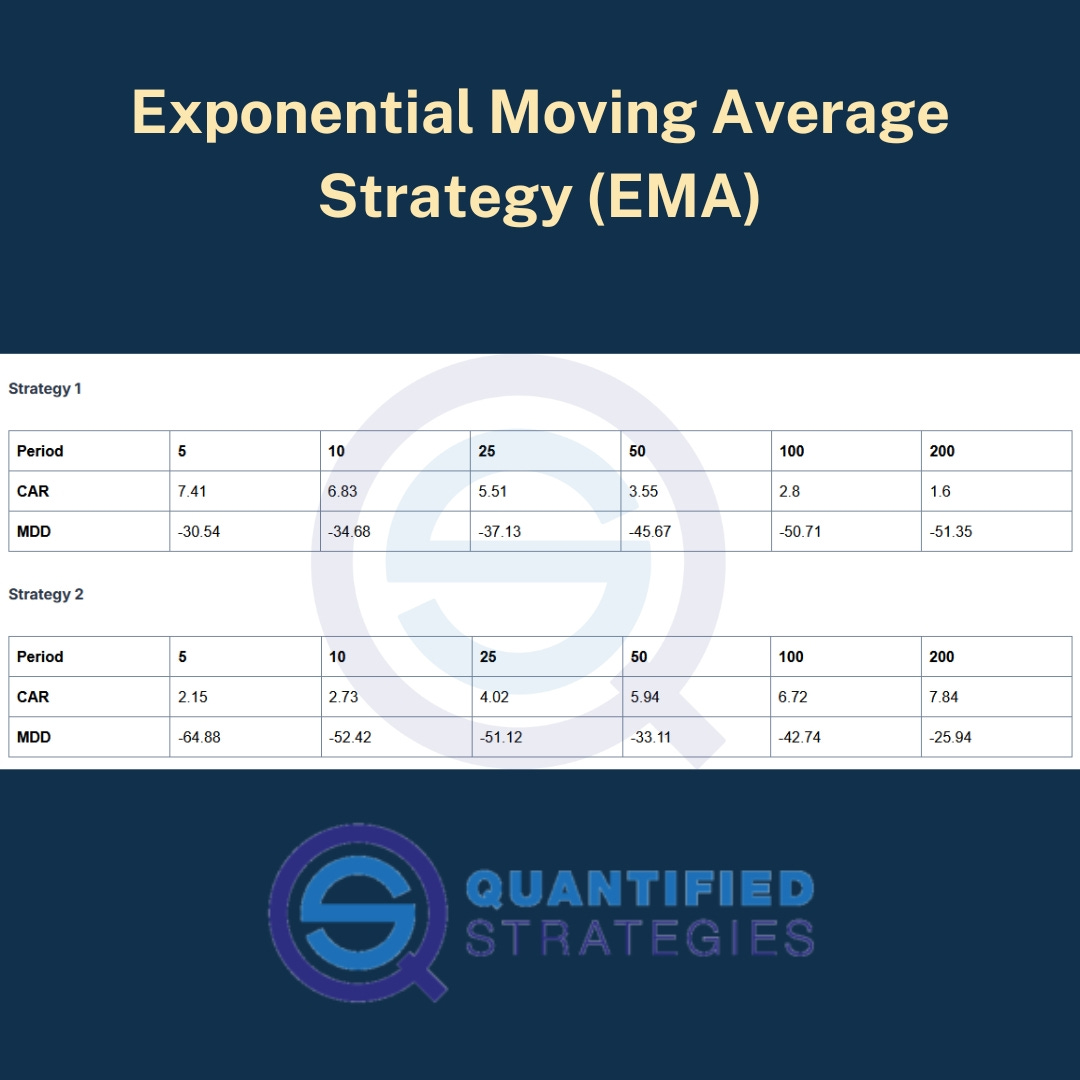

Backtests indicate that exponential moving averages strategy do work: They can be useful for mean-reversion strategies if you use a short number of days in the moving average, and useful for long-term trend following if you use a high number of days in the moving average.

We backtest the following trading rules:

Strategy 1: When the close of SPY crosses BELOW the N-day moving average, we buy SPY at the close. We sell when SPY's closes ABOVE the same average. We use CAGR as the performance metric.

Strategy 2: Opposite, when the close of SPY crosses ABOVE the N-day moving average, we buy SPY at the close. We sell when SPY's closes BELOW the same average. We use CAGR as the performance metric.

Strategy 3: When the close of SPY crosses BELOW the N-day moving average, we sell after N-days. We use average gain per trade in percent to evaluate performance, not CAGR.

Strategy 4: When the close of SPY crosses ABOVE the N-day moving average, we sell after N-days. We use average gain per trade in percent to evaluate performance, not CAGR.

The results from the two first backtests are shown in the image below.

We published the backtest results of the other 2 strategies of Exponential Moving Average Strategy (EMA) and how to calculate EMA here >>

https://www.quantifiedstrategies.com/exponential-moving-average-trading-strategy/