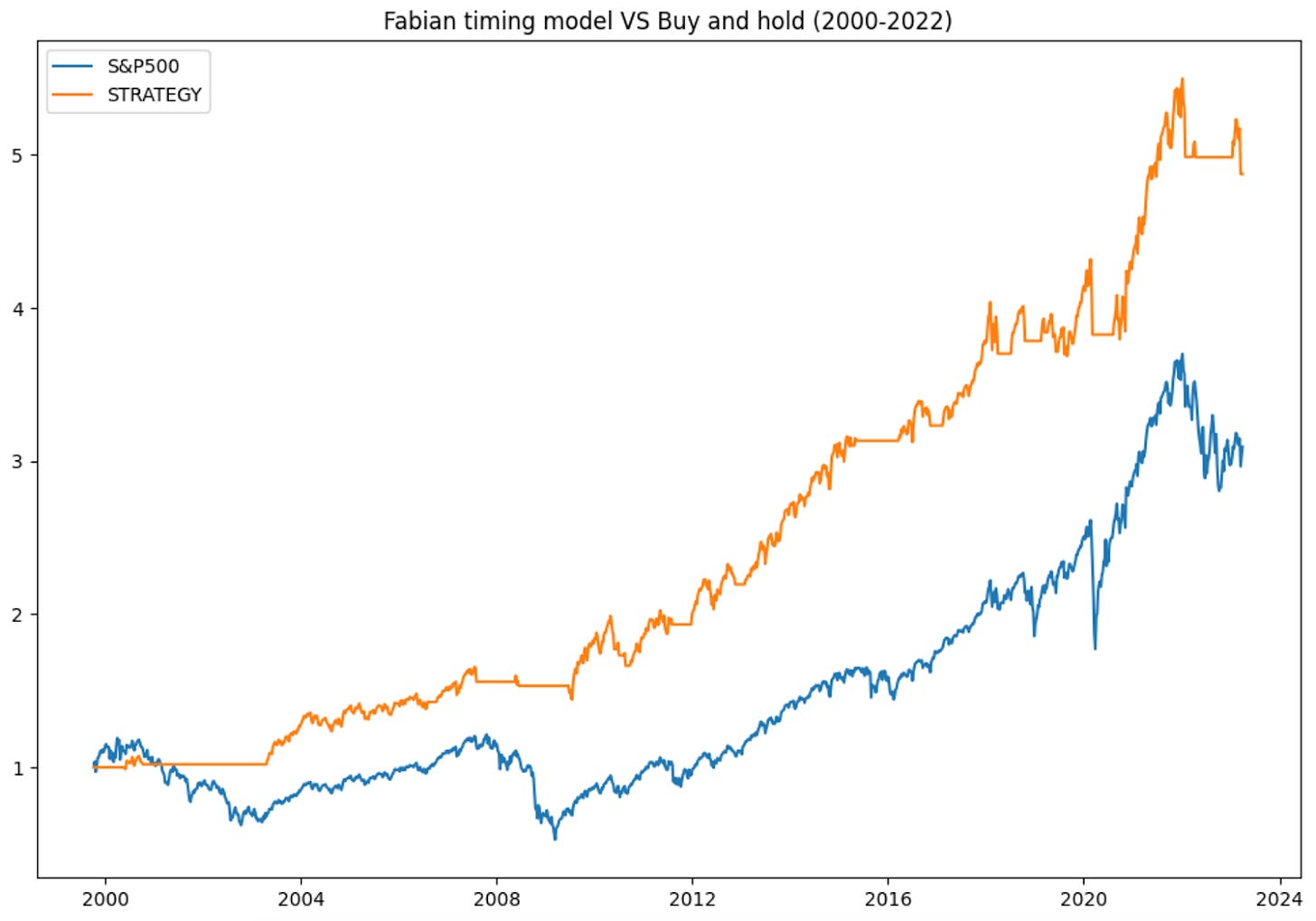

The Fabian timing model is a simple quantitative long-term trend-following strategy for the stock market. It is based on an intermarket signal between the S&P 500, the Dow Jones Industrial Average, and the utilities sector.

(Trading rules at the bottom for paying subscribers. We publish such articles weekly.)

The model was created by Richard Fabian, a very successful writer, money manager, author, and speaker. He explains this strategy in his book The mutual fund wealth builder.

Although he argued that no one could come up with consistently good market timing predictions on their own, nor was he smart enough to assess all available information correctly, he strongly recommended adhering to some mechanical system. Also, he did not say that his model was perfect, but that by trying to perfect any timing model, we would have no strategy.

We backtested it using Python (trading rules beneath the equity curve):

CAGR is 6.95% (buy and hold 4.90%)

The standard deviation is 9.87 (17.96)

Time spent in the market is 56.20%

Risk-adjusted return is 12.34% (CAGR divided by time spent in the market)

Total trades were 31

Maximum weekly drawdown is 16.38% (56.52%)