Intraday trading strategies refers to a style of trading where a trader buys and sells a financial instrument within the same trading day. The financial instrument can be stocks, futures, or forex. Intraday trading can be scalping — a trading method that tries to profit from small price fluctuations that happen all through the trading day. It can also be day trading — a trading method that aims to capture the major price movements of each trading day but ensures to close all positions before the market closes for the trading day.

In this post, we take a look at intraday trading and the strategies used for it and we end the article by backtesting a couple of intraday trading strategies.

The strategy and logic are straightforward: we want to enter a position after a series of lower lows and lower highs in a row.

We backtest the following trading rules:

* We use hourly bars.

* We enter long at the close when the bar is the third lower low and third lower high in a row.

* We enter a position only at 1030 local NY time.

* We sell at the close of 1600 NY time.

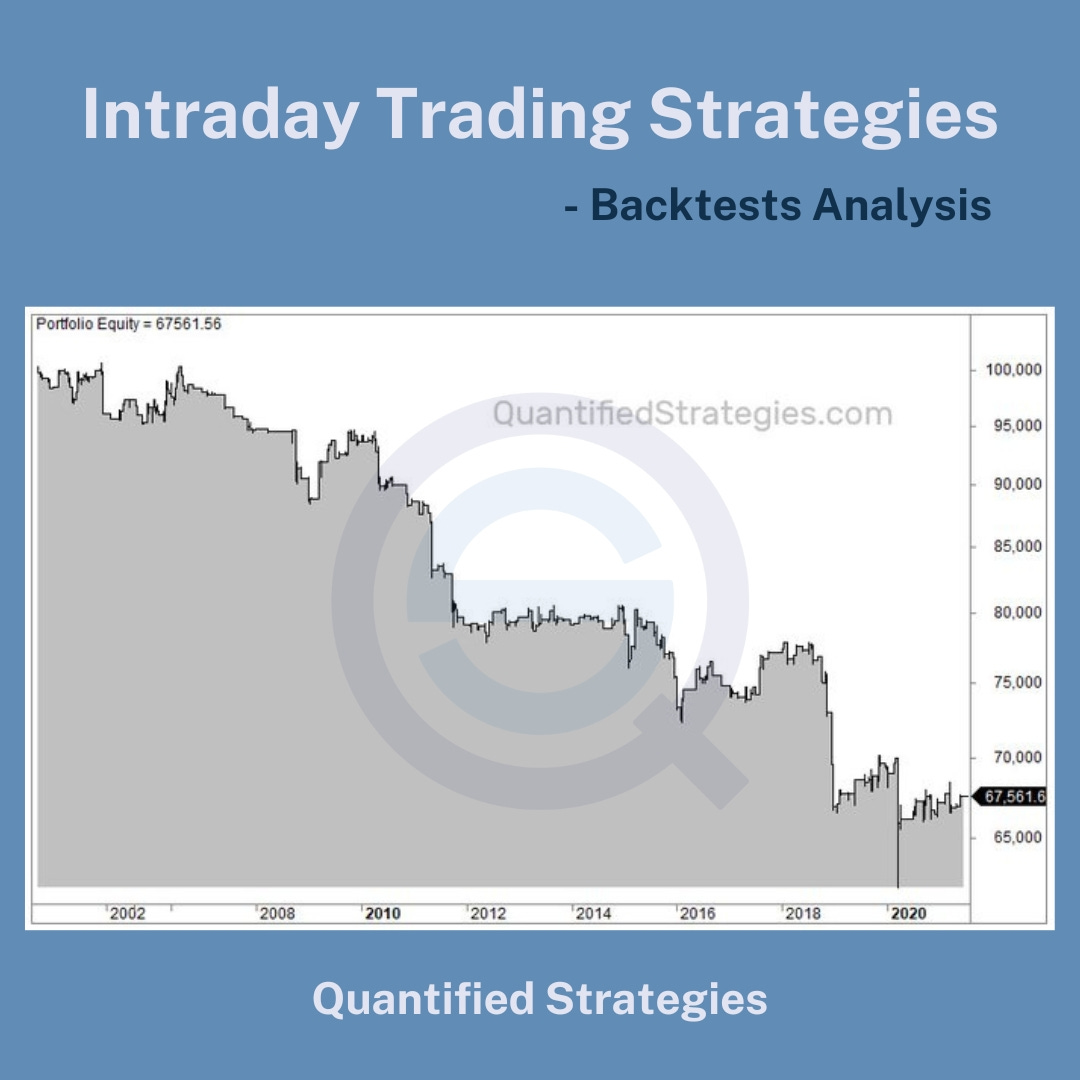

We backtested the strategy on the WTI crude oil futures contract traded on NYMEX. The equity curve (2000 – 2021) looks like the image shown below.

We also tested the strategy with unknown data for a certain time and found it works even better. Check out here >>

https://www.quantifiedstrategies.com/intraday-trading-strategies/