Is The Tax Day Good Or Bad For Stocks?

Most US taxpayers have a deadline on the 15th of April to file their tax returns. If the date is on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day. Does the Tax Day signal any bullish or bearish trading signal? Is the Tax Day good or bad for stocks?

This is our free newsletter. For a list of the Bonus Articles we have for our Supporting Members, please press here.

Alternatively, you can test our subscription:

Considering that April has been a very strong month for stocks for over 50 years, we argue that the Tax Day doesn't signal any particular bullish or bearish signal. We backtested the two weeks prior to Tax Day and the two weeks after Tax Day. However, Tax Day itself offers slightly stronger returns than any random day.

What is the US tax day?

The US Tax Day generally falls on the 15th of April, unless this is a weekend or holiday. In 2022 the US Tax Day was on the 18th of April because the 15th was Good Friday and a non-trading day. The only exception is in the state of Massachusetts where they get an additional day to file due to their local Patriots Day.

Why should the Tax Day affect stocks?

The stock market is influenced in the long term by valuations and future prospects, but in the short run, it might be heavily influenced by capital inflows and outflows.

Below is just two examples of why Tax Day could affect the stock market:

It gives incentives to realize losses to offset gains in other stocks.

Investors and traders might take out capital from the markets to pay taxes.

The days prior to Tax Day

April is historically one of the best months of the year. However, the returns in the first two weeks are substantially better than in the last two weeks.

First, let's look at the performance leading up to the Tax Day deadline:

We buy at the close of March and we sell on the 15th of April or the next trading day (see sell at the close). Since 1960 the return in the S&P 500 looks like this:

The average gain is a respectable 1.13% and the win rate is 65%.

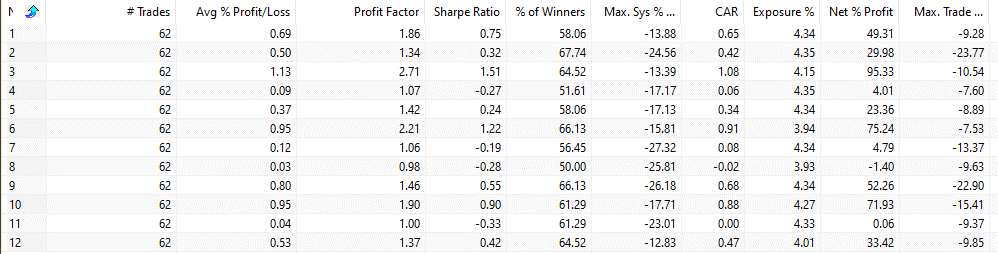

It turns out that the first two weeks of April are, by far, the best first two weeks of any month of the year. Below shows the returns when you buy at the close of the month and sell on the 15th of the next month (or the first trading day after the 15th):

The first column shows the month. For example, 3 means we buy at the close of March and sell on the 15th of April.

The days after Tax Day

Let's backtest the performance for the rest of April after Tax Day:

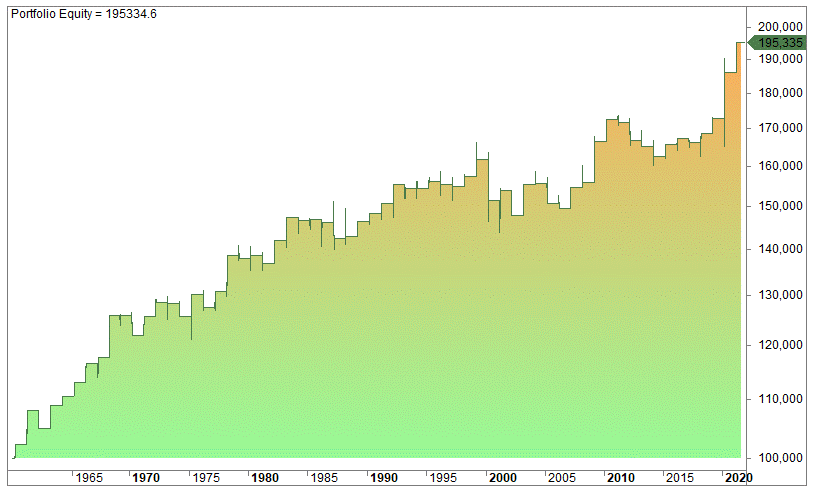

If we enter at the close of the first trading day after the tax file deadline and sell at the close of April, we get this equity curve:

The average gain per trade is a moderate 0.33% and the win rate is 60%.

Below are the gains of every month if you buy at the close of the 15th or the first trading day after the 15th and sell at the close of the month:

April is in the 4th row and there are three other months that show better performance.

Keep in mind that the performance in April might also be influenced by the options expiration week effect and the week after options expiration day.

The returns on the US Tax day

We like overnight trading strategies, and thus let's check the performance of buying at the close of Tax Day and selling at the close the next day. This is what the cumulative returns look like:

The average gain per trade is 0.06% and the win rate is 53%. This is slightly more than the average gain of 0.04% per day which is the average over the last three decades.

Does Tax Day affect the stock market? Conclusions

April is a very strong month for stocks, but it's hard to tell positively or negatively how does Tax Day affect the stock market. It might as well be other seasonals making this a strong month, one of them being the options expiration.