In this post, we look at the performance of the Double Seven trading strategy over the last twenty-one years in a wide range of liquid ETFs.

Does the Double 7 still work? Yes, the trading strategy still works, but Larry Connors has other strategies that work better.

We backtest the following trading rules:

The close must be above the 200-day moving average.

The close must be at a seven-day low.

If 1 and 2 are true, then go long at the close.

Sell when the close is at a seven-day high (sell at the close).

This is all there is to it. No stop loss. A pretty simple strategy that can be tested in two minutes. We look at the ETF with the longest history: the S&P 500 represented by the ETF SPY.

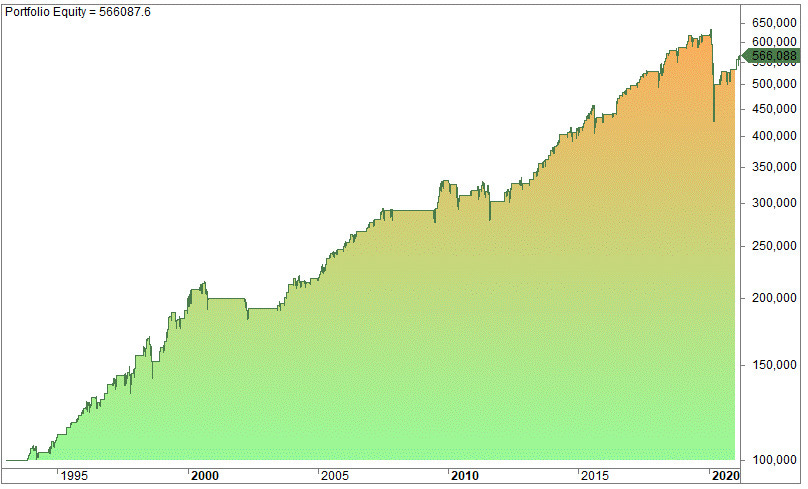

SPY’s equity chart looks like the image shown below.

You can find more info about this trading strategy here:

https://www.quantifiedstrategies.com/larry-connors-double-seven-strategy-does-it-still-work/