Larry Connors’ Multiple Days Up And Multiple Days Down | Trading Strategies Analysis

Chapter 6 of Larry Connors‘ High Probability Trading contains a trading strategy called Multiple Days Up (MDU) And Multiple Days Down (MDD). The main idea of the strategy is that ETFs revert to their mean. Because ETFs consist of many stocks or holdings, they are unlikely to go to zero. Thus, they should perform better for mean reversion than for single stocks, which can go to zero.

In this strategy, we look to buy when an ETF has dropped 4 out of the last 5 trading days. The trading rules are like this:

* The close is above the 200-day moving average.

* The close must be below the 5-day moving average.

* The ETF must have dropped at least 4 days out of the last 5 trading days.

* If 1-3 above is true, then enter at the close.

* Sell on the close when the ETF closes above its 5-day moving average.

* No stop-loss.

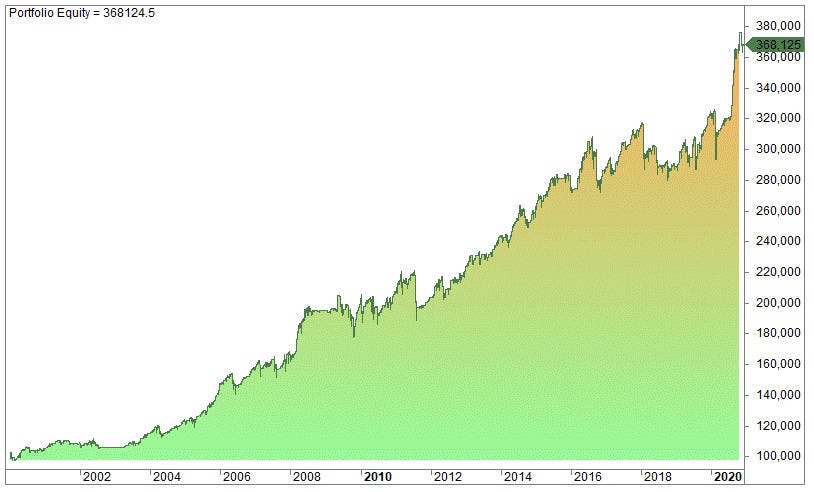

The equity curve looks like the image shown below.

If you like to know the code of Connors’ strategy plus the code for all the other free strategies check out here >>

https://www.quantifiedstrategies.com/larry-connors-multiple-days-up-and-multiple-days-down-strategy/