Larry Connors’ Multiple Days Up And Multiple Days Down - Trading Strategies Analysis

Chapter 6 of Larry Connors‘ High Probability Trading contains a trading strategy called Multiple Days Up (MDU) And Multiple Days Down (MDD). The book was published in 2009, the trading tests were done until 31st of December 2008, and it’s time to test and check how the strategy has performed since then.

In this strategy, we look to buy when an ETF has dropped 4 out of the last 5 trading days. The trading rules are like this:

- The close is above the 200-day moving average.

- The close must be below the 5-day moving average.

- The ETF must have dropped at least 4 days out of the last 5 trading days.

- If 1-3 above is true, then enter at the close.

- Sell on the close when the ETF closes above its 5-day moving average.

- No stop-loss.

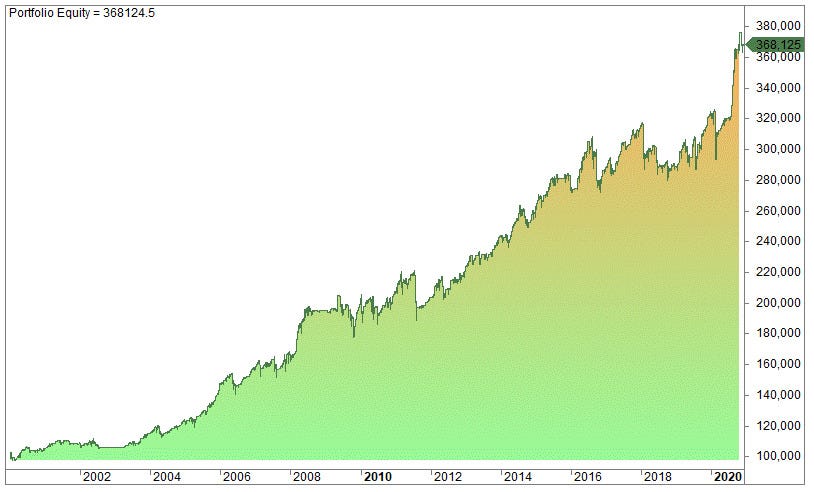

The equity curve looks like the image shown below.

Can the strategy be improved or made different? If you have any suggestions, please comment 👇

https://www.quantifiedstrategies.com/larry-connors-multiple-days-up-and-multiple-days-down-strategy/