Market timing, Scaling In, And The Rubber Band Strategy

First, a reminder about our weekly strategy report for stocks, bonds, and gold:

Rubber Band trading strategy:

The Rubber Band trading strategy aims to identify points where the market is overbought or oversold and likely to snap back towards the mean.

In the article below, we provide you with trading rules for a profitable mean reversion strategy:

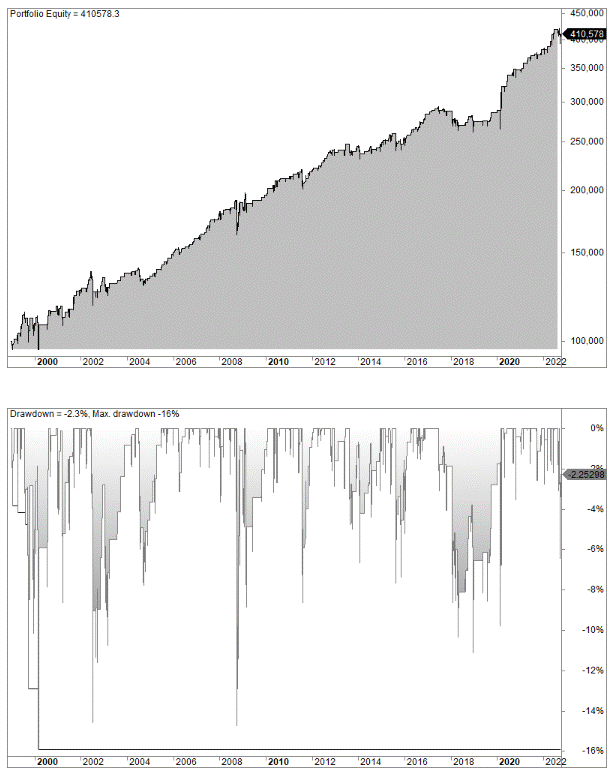

This is what the equity curve and drawdowns look like:

Scale-in trading strategy:

In mean reversion strategies, it might be wise to scale-in instead of allocating all your capital at once. In the backtest below we show you how the average gain per trade increases when scaling-in, but the tradeoff is lower total returns (because less capital is put to use - trading is always a tradeoff between many factors).

Market timing:

Has the market bottomed? Is now the right time to buy?

These are typical questions that many long-term investors or position traders contemplate. But does it really matter? (Short-term trading is a different matter, though.)

We decided to do some backtests by removing just a few observations from the datasets to see what happens to the long-term compounding:

VWAP trading strategy

Our last backtest of the day is a moving average strategy: