Pullback Trading Strategies (Backtest, Setup, Rules, Performance)

A pullback trading strategy is a trading strategy that involves buying a stock after it has experienced a recent decline in price. The rationale behind this strategy is that the stock is likely to rebound from its recent decline and return to its previous price level or even higher.

We backtest the following trading rules:

The close must be above the 200-day moving average.

The close must be below the 20-day moving average.

The five-day RSI must be below 45.

If 1–3 are true, then enter at the close.

Exit at the close when the five-day RSI ends above 65.

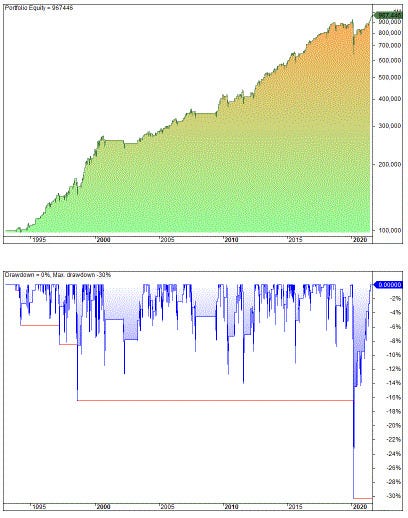

Below is the equity chart of 100 000 compounded from 1993 until September 2021, showing a clear uptrend in stock price. (Shown in image)

You can find more info about this trading strategy here:

https://www.quantifiedstrategies.com/pullback-trading-strategy/

#PullbackTrading #TechnicalAnalysis #Backtesting #tradingstrategy #systematictrading #investing #trading #tradingtips #algotrading