Reversal Day Strategy – Backtest and Overview (Bullish Reversal-Market Turnaround)

In this post, we will discuss the idea of a reversal day strategy, its potential causes, and the significance of identifying these signals in the stock market.

We backtest the following trading rules:

* Today's low is lower than yesterday's low

* Today's close is higher than yesterday's close

* The five-day RSI must be lower than 35

The last trading rule (RSI) indicates that the trend has been negative over the last few days. The trading rules above are just one example of how you can define a reversal day. There are, of course, unlimited ways you can define such a turnaround.

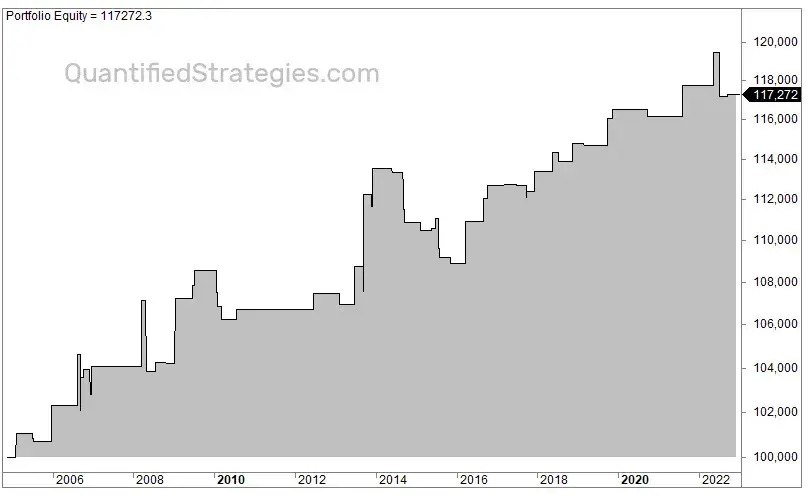

The equity curve if we exit after one day looks like the image shown below.

Can the strategy be improved or made different? If you have any suggestions, please comment 👇

www.quantifiedstrategies.com/reversal-day-trading-strategy/