Stock Market Index Trading Strategies (Video, Rules, Backtest, Settings, Performance)

Stock market index trading refers to buying and selling a specific stock market index via a derivative instrument that tracks the index. The strategies traders use to speculate on whether the price of an index will rise or fall are known as stock market index trading strategies, and they include trend-following and mean-reversion strategies.

We backtest the following trading rules:

Our strategy for trading Nasdaq-100/S&P 500 was published to our members in August 2021: Volatility Swing Trade Nasdaq/S&P 500. Obviously, we don’t want to publish the trading rules — we believe the strategy is too good to be given away for free.

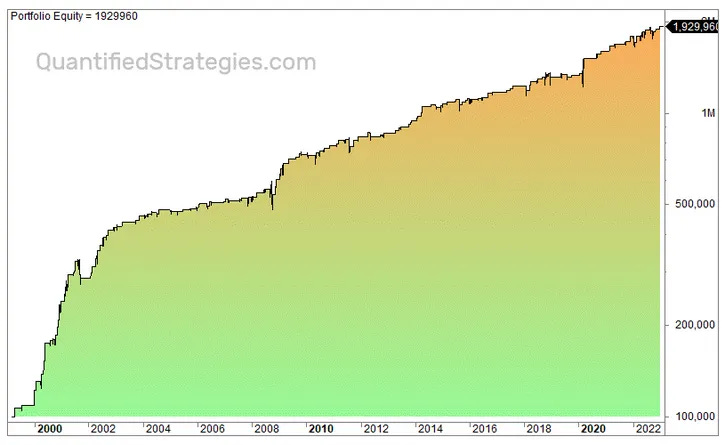

The strategy’s performance is illustrated in the equity curve (Shown in the image below)

The trading performance, statistics, and metrics read like this:

No. of trades: 178

Average gain per trade: 1.73% (2.76% for winners and -2.31% for losers)

Win ratio: 80%

Profit factor: 3.3

CAGR/annual return: 13.1%

Exposure/time in the market: 11%

Max drawdown: -19.5%

Risk-adjusted return: 121% (CAGR divided by time spent in the market — 13.1/0.11)

The strategy performed very well during recessions, as we had in 2000–2003, 2008, and 2022. For example, during the bear market of 2022, the strategy had 14 trades and 5 losers, but still, the overall gains were 7.9%.

You can find more info about this trading strategy here:

https://www.quantifiedstrategies.com/stock-market-index-trading-strategies/

#Nasdaq100 #SP500 #VolatilityTrading #CAGR #tradingstrategy #systematictrading #investing #trading #tradingtips #algotrading