S&P 500 shows above-average returns during the options expiration week. Only July and January show negative returns during the options expiration week, while April is the best month. Overall, there seems to be an options expiration week effect.

Below we discuss aspect of the options expiration week and how stocks perform during that particular week. Also, please remember that the week is often referred to as OPEX week.

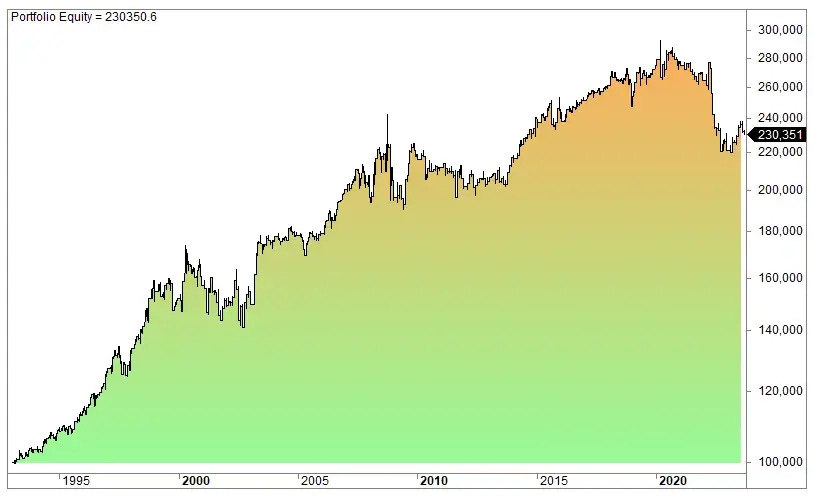

Based on the assumed positive effect options expiration has on stock returns, we can backtest a simple trading strategy that buys on the open of the options expiration week and exits on the close of the options expiration day (usually a Friday). We own stocks this week and stay in cash the rest of the time.

If Monday is a holiday, we enter on Tuesday. Likewise, if Friday is a holiday, we exit on Thursday.

The equity chart below shows the compounding returns of being only invested in the S&P 500 during the options expiration week (from the open of the week to the close of the week — 100 000 compounded)

You can find more info about this trading strategy here:

https://www.quantifiedstrategies.com/the-option-expiration-week-effect/