Trading SPY And S&P 500 Using VIX (VIX Trading Strategies). The VIX is a popular measure of the implied volatility of S&P 500 index options. Put shortly, the VIX is a mean reversion indicator: when the risk premium increases (VIX is rising in value) it might be wise to buy stocks and sell when VIX drops in value.

The VIX measures how much investors expect the stock market to swing up or down. When it goes up, it might be a good time to buy stocks, and when it goes down, it could be a good time to sell. This article talks about different ways to trade based on the VIX’s movements.

In this post, we present backtested VIX trading strategies.

We backtest the following trading rules:

We’re using a 10-day moving average for the BB. I like to use short time frames since they are more responsive. First, let’s try with a standard deviation of 3 for the upper band. When testing, there is no fills using 3 STD.

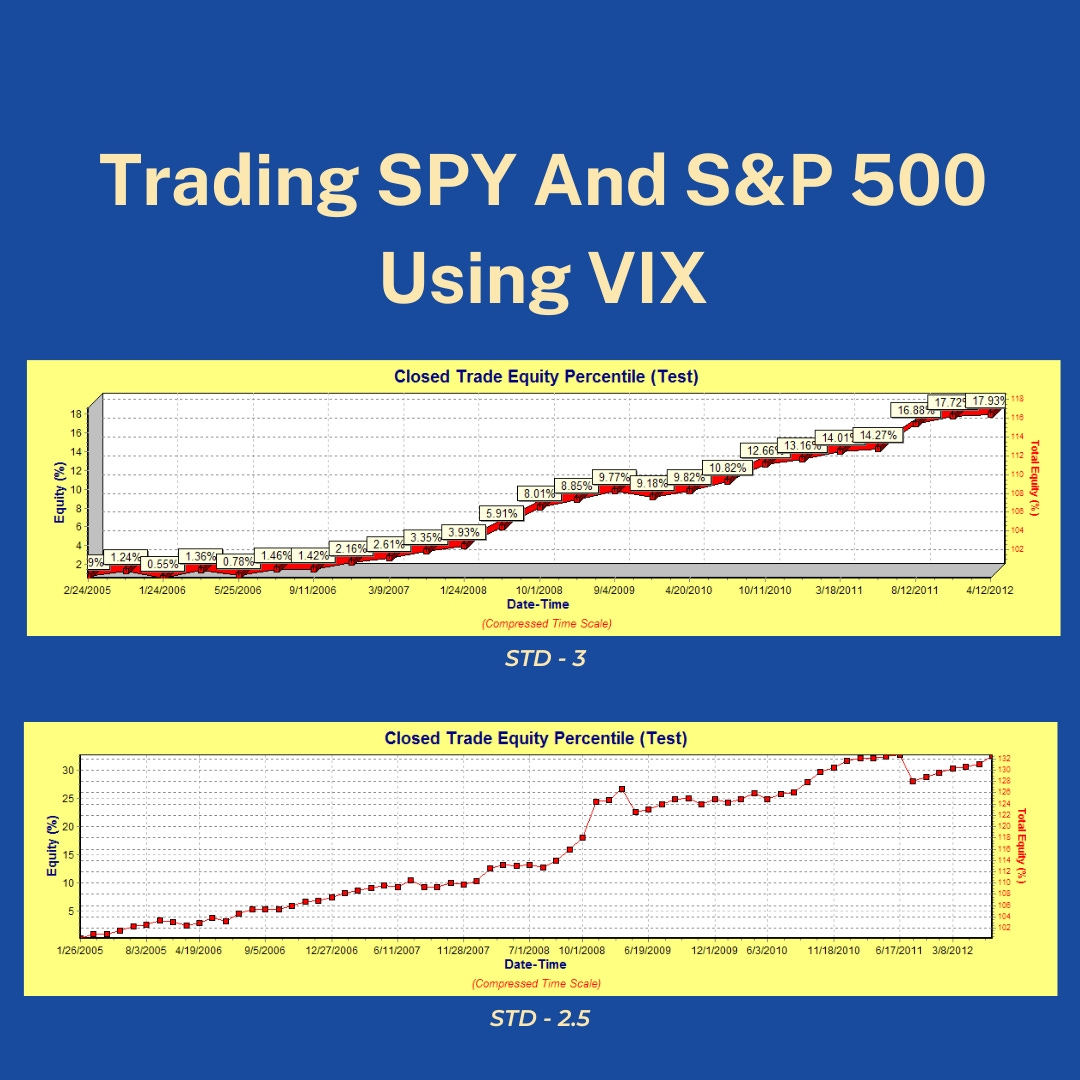

Here are the results using a standard deviation of 3 (Shown in the image below)

You can find more info about this trading strategy here:

https://www.quantifiedstrategies.com/using-vix-to-trade-spy-and-sp-500/

#TradingStrategies #VIX #SPY #SP500 #VolatilityTrading #Backtesting #MeanReversion #RiskManagement