TRIN (Arms Index) Trading Strategy: Exploring the Concept and Conducting a Backtest

The Arms index or short-term trading index (TRIN) is a market sentiment indicator that helps gauge the internal strength or weakness of a market. It compares the number of increasing and decreasing stocks (AD Ratio) to the increasing and decreasing volume (AD Volume).

We backtest the following trading rules:

* When today's TRIN reading is above 100, we go long the S&P 500 (SPY) at the close.

* We sell at the close when today's close is higher than yesterday's high.

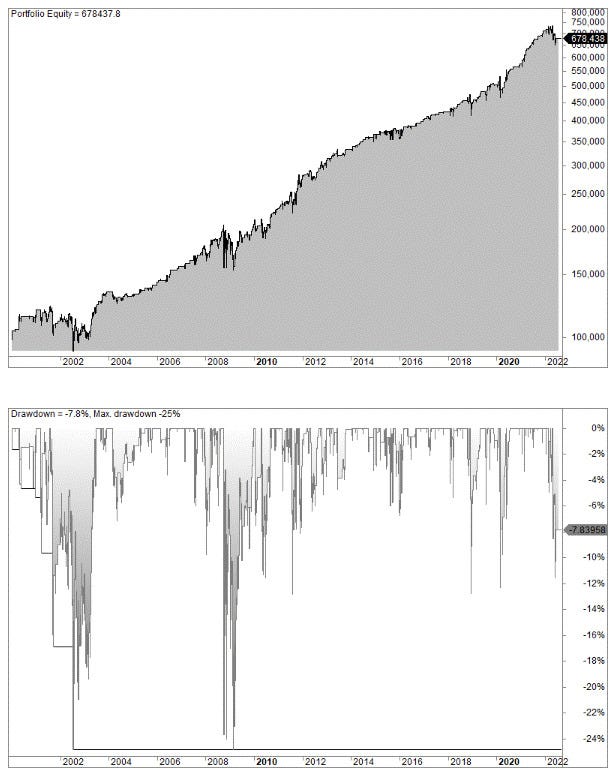

The equity curve of this simple trading strategy looks like this:

We have done another TRIN (Arms Index) Trading Strategy backtest adding a second trading indicator to the trading rules and it has the best result. Check it here https://www.quantifiedstrategies.com/trin-strategy/