The Triple RSI trading strategy is a modified version of the RSI strategy with four key variables, three of which are based on the RSI. It focuses on mean reversion, and the trading rules involve conditions related to RSI readings, the 200-day moving average, and buying/selling signals.

The Triple RSI trading strategy is also based on mean reversion. The trading rules are inspired by Larry Connors’ R3 strategy, but we have modified them.

These are the trading rules:

The 5-day RSI is below 30, and

The 5-day RSI reading is down for the third day in a row, and

The 5-day RSI reading was below 60 three trading days ago, and

The close is higher than the 200-day moving average, and

If 1–4 are true, then buy at the close.

Sell at the close when the 5-day RSI crosses above 50.

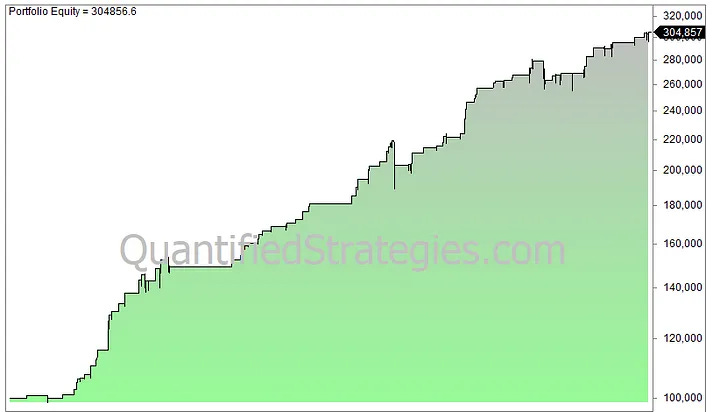

We backtest SPY — the ETF that tracks S&P 500. When we put the trading rules above into Amibroker, we get the following equity curve (Shown in the image)

You can find more info about this trading strategy here:

https://www.quantifiedstrategies.com/triple-rsi-trading-strategy/