Turn of The Month Strategy

The turn of the month strategy, sometimes referred to as the Ultimo Effect or end-of-month effect, is a well-known seasonal trading anomaly in the stock market.

This strategy capitalizes on the positive market bias that occurs during the last trading days of a month and the first trading days of the next month.

Strategy Mechanics and Trading Rules

The turn of the month strategy involves focusing on the period around the transition between months.

• Entry Point: Go long at the close on the fifth last trading day of the month.

• Exit Point: Exit at the close of the third trading day of the next month.

By following these rules, the strategy is invested only around 33% of the time. The strategy frequently beats a simple buy-and-hold approach despite its low exposure time.

The potential cause of this effect is thought to be structural forces, such as increased inflow of capital from savers or rebalancing activities conducted by fund management businesses.

This behavior is believed to be structural, suggesting the strategy is likely to continue working well in the future, especially since it performed consistently in the S&P 500 for over 60 years, even before passive index funds became common.

Performance in the S&P 500

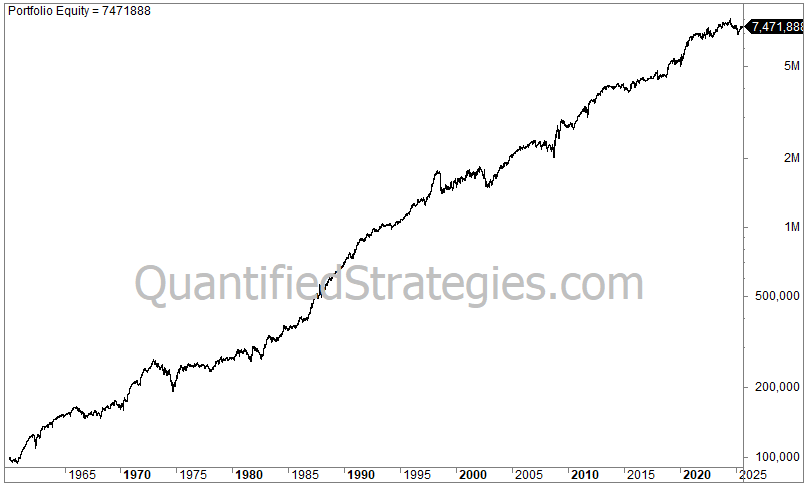

The turn of the month strategy has performed remarkably well for the S&P 500 since at least 1960. The seasonality in the stock market has been observed for six decades.

If an investor had invested only during the last four and first three trading days of the month, they would have beaten buy and hold with significantly lower drawdowns (though results are not adjusted for dividend reinvestments).

S&P 500 Performance (since 1960):

• CAGR/annual return: 7% (compared to buy and hold cash index: 7.5%).

• Max drawdown: 27% (compared to buy and hold: 56%).

The drawdowns for the turn of the month strategy are both smaller and last shorter than those experienced by a buy and hold approach.