Yes, the turtle trading strategy still works today. It is a trend-following strategy, so it works in markets with clear trends. While the original strategy, which is based on identifying breakouts, still works reasonably well, traders have modified the turtle trading rules by using technical indicators for trend identification. The technique may not be as profitable as in the 1980s, but traders can still use it to earn good returns, as indicated by the Barclay CTA index and successful hedge funds, like Swedish Lynx, for example.

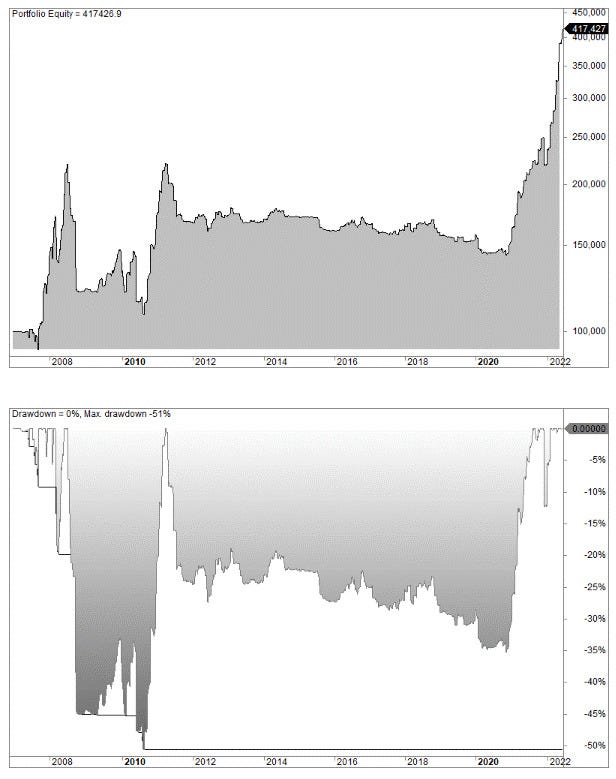

We’ll do some backtests on a basket of continuous futures contracts. The backtest period is from 2007 until today.

Trading rules (monthly bars):

If the close is higher than 6 months ago, buy and hold the position for one month.

If the close is lower than the close 6 months ago, sell and stay out for the coming month.

Rinse and repeat monthly.

The equity curve looks like the image shown below.

You can find more info about this trading strategy here:

https://www.quantifiedstrategies.com/turtle-trading-strategy/