Ultimate Oscillator Indicator Trading Strategy (Backtest And Example)

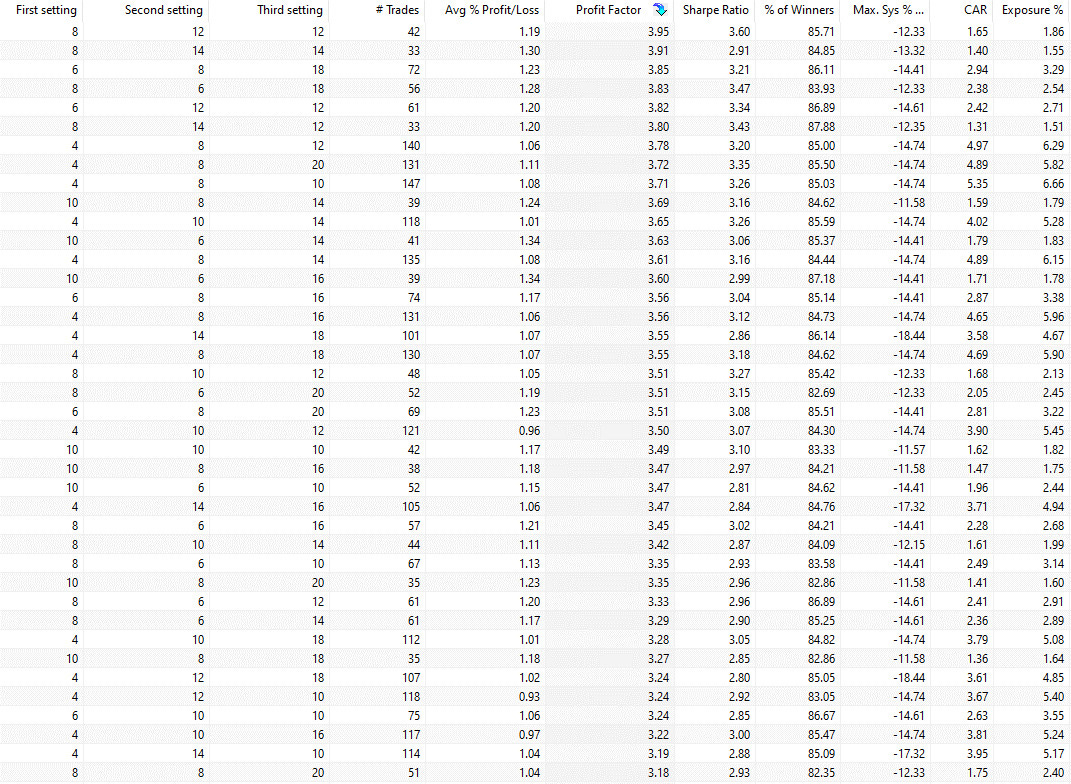

The ultimate oscillator (UO) is a momentum indicator designed to measure the price momentum of an asset across multiple timeframes. It uses three different periods (7, 14, and 28) to ascertain the momentum in the short, medium, and long-term market trends and then generates a weighted average of the three. Our backtests indicate that the indicator performs well over practically all settings, and you can make a very profitable mean reversion trading strategy out of it.

We backtest the following trading rules:

* The first setting has a minimum value of 2 - a max of 10 (interval of 2)

* The first setting has a minimum value of 6 - a max of 14 (interval of 2)

* The first setting has a minimum value of 10 - a max of 20 (interval of 2)

* The buy threshold is set to 30 for all simulations

* We sell when the close is above yesterday's high

This is many simulations and below we have an excerpt ranked on profit factor (Shown in the image)

We have backtested the strategy with different profit factors and shown the annual returns here >>

https://www.quantifiedstrategies.com/ultimate-oscillator-strategy/