Uncorrelated Assets And Strategies - Why Combine Them (Examples And Backtests)

Uncorrelated or non-correlated assets and strategies are important considerations for your portfolio. The reason why is because it has the potential of both reducing volatility (risk) and increasing returns. You kill two birds with one stone.

That said, this is not an easy task. In the article linked below, we show you examples and backtests of the power of making a diversified and uncorrelated portfolio of both different assets and strategies.

Uncorrelated Assets And Strategies – Benefits And Advantages (Examples And Backtests).

This is our free newsletter. For a list of the Bonus Articles we have for our Supporting Members, please press here.

Alternatively, you can test our subscription:

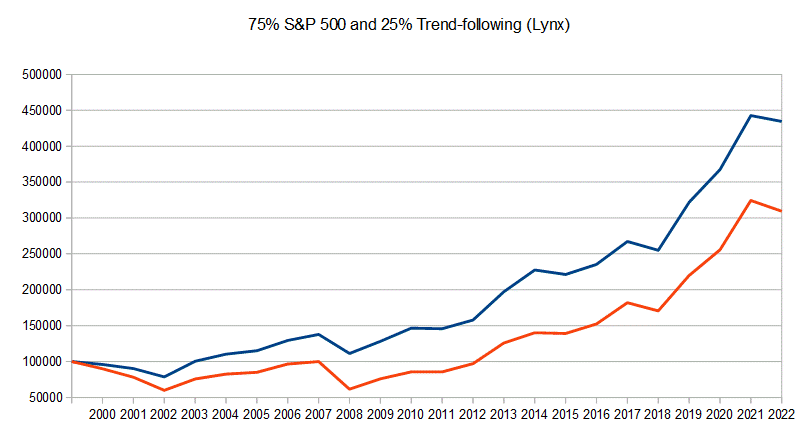

Below is an example of combining the S&P 500 and the Swedish systematic trend fund Lynx: