When stock markets are oversold, we can expect strong returns over the next few days. But in the long term, returns gravitate toward the average returns. Thus, oversold stock markets only predict short-term results, not long-term. We do a backtest to prove our point.

We do a simple backtest that has the following rules:

We buy at the close when the 3-day RSI is below 20.

We sell at the close when the close is higher than yesterday’s high.

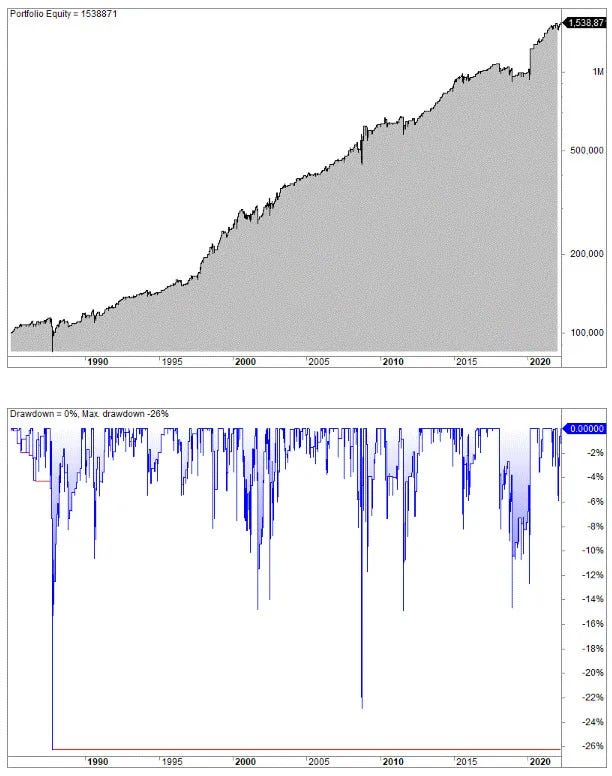

If we backtest this simple trading strategy on S&P 500 from 1985 until today, we get the equity curve shown below.

You can find more info about this trading strategy here:

https://www.quantifiedstrategies.com/what-happens-when-stock-markets-are-oversold/