In this post, we explain how to use Williams %R in a trading strategy, and finally, we backtest trading strategies to see if Williams %R works. Does it work? Our conclusion is that Williams %R seems to work pretty well.

We backtest the Williams %R trading strategy on the S&P 500 (SPY) and we make the following trading rules:

Entry is at the close when the Williams %R is below -90 and exit, when we sell, is when today's close is higher than yesterday's high or when the Williams %R closes above -30.

By using optimization we get, perhaps as expected, the best results on short lookback periods. We used a minimum lookback period of two days and a maximum of 25 days. All tests gave a profit factor of two or more, except for 25 days which produced 1.9.

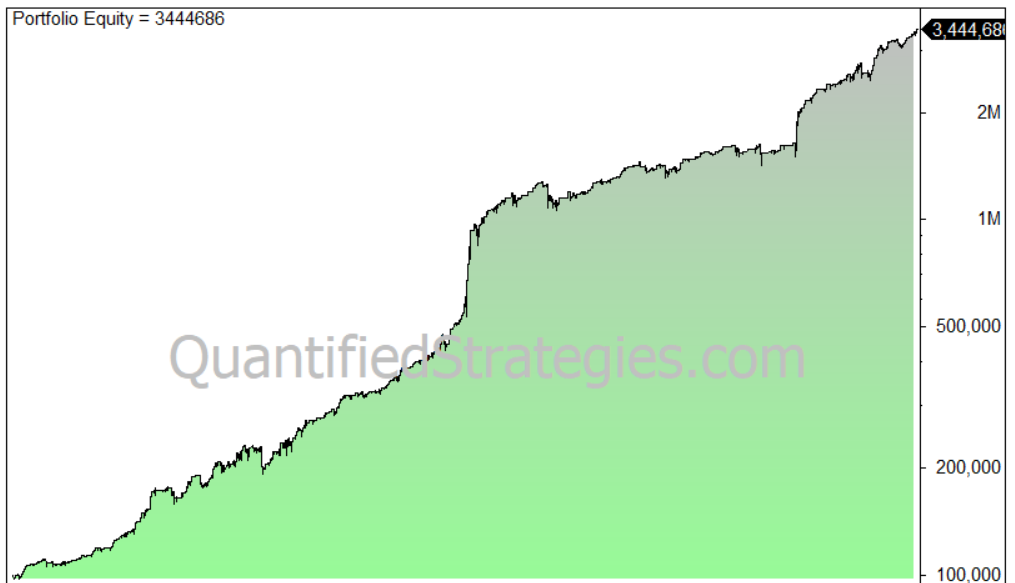

The best result is by using a two-day lookback period. This gives the equity curve shown below.

We test different trading strategies to get the comparison with RSI and explain which works best for different settings. Check out here>>

https://www.quantifiedstrategies.com/williams-r-trading-strategy/